Looking back to the year 2023

Looking back on 2023, it is fair to say that the past year in the venture capital industry went pretty much as most VCs and experts had imagined at the end of 2022:

Ein deutlicher Rückgang vom investierten Kapital – insbesondere in der Growth Stage (gemäss GP Bullhound haben Investoren vergangenes Jahr 45 Prozent weniger Geld in europäische Startups gesteckt als noch ein Jahr zuvor), eine deutliche Erhöhung von Insolvenzen im DACH Raum (gemäss Handelsblatt mussten allein in Deutschland 297 Startup-Firmen Insolvenz anmelden), ein weiterer Rückgang der Unternehmensbewertungen sowie ein sehr zurückhaltender M&A Markt (vorsichtig ausgedrückt). Vom Geopolitischen wollen wir erst gar nicht anfangen.

Wenn wir bei EquityPitcher auf unser 2023 zurückblicken, dürfen wir auch von diesem Jahr wieder behaupten, dass es das it was the most successful year in our company's history to date which fills us with enormous gratitude!

First of all, we must of course say that the past year was also very challenging for us and there was a lot to overcome. Some of our portfolio companies found it very difficult to achieve operational growth, others had a tough time with fundraising and there were also a few other issues that we would have liked to have seen differently.

But to summarise: even after the end of 2023 all 25 companies, with which we started the year are still doing well.

Portfolio Highlights

The only difference compared to previous years is that our portfolio has nevertheless been reduced by 3 companies, such as Opinary, which was bought entirety, another exit was a secondary transaction as in the case of YukkaLab and finally in the case of Viselio, a share buyback programme was implemented.

Was wir in 2023 deutlich gespürt haben, war die Zurückhaltung der Startups ins Fundraising zu gehen – was mit Sicherheit an eingangs genannten Gründen lag. Die Unternehmen, die ein starkes Cap Table haben und ein gutes Wachstum aufweisen konnten, haben von den bestehenden Investoren meist Geld für eine Zwischenfinanzierung erhalten. Dies ist auch der Grund, warum wir in 2023 nur in 3 new startups namely Wingtra, Sewts and Threedy.

We therefore ended 2023 with 25 portfolio companies.

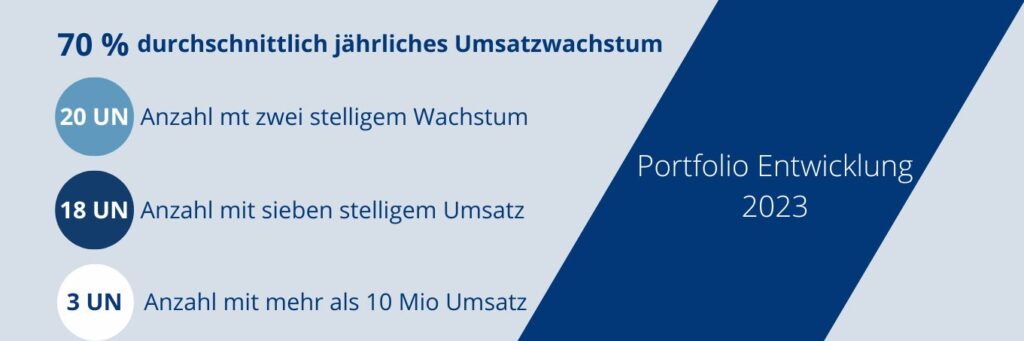

A few key figures are enough to show the very positive development of our portfolio companies for 2023 despite all the adversity:

20 unserer Portfoliounternehmen haben ein 2-stelliges Wachstum erreicht! Dies unter Einbezug, dass 18 der Unternehmen 7-stellige Umsätze machen wovon 3 mehr als 10 Millionen CHF realisiert haben, zeigt sehr deutlich, dass sich das Portfolio auch in diesem extrem anspruchsvollen Jahr 2023 überdurchschnittlich gut entwickelt hat. Auf das Gesamtportfolio gesehen, gab es ein durchschnittliches Umsatzwachstum in Höhe von über 70%.

In total, over CHF 80 million was invested in our current portfolio companies in 2023, bringing the total amount invested in them to around CHF 250 million!

In addition to various CLAs and equity rounds granted by existing investors as bridge financing, the equity financing rounds of Anybotics with USD 50 million in fresh capital, Wingtra with CHF 20 million, Sewts with EUR 7 million, Rready with CHF 4 million, Sinpex with EUR 4 million and AirConsole with CHF 3 million in fresh capital play a major role here.

In 2023, the circle of our international co-investors grew in particular. With Bessemer Venture, Walden Catalyst, NGP Capital and Aramco, it is clear to see that our start-ups are on the right track and that they are also attracting interest beyond the borders of the DACH region.

Of course, we have also welcomed great local co-investors such as Emerald Ventures, Swiss Canto & TX Ventures.

Together with these great investors, our current portfolio companies have managed to grow to the remarkable number of more than 1,000 employees!

If you consider that the Federal Republic of Germany is investing EUR 10 billion in an Intel site in Saxony-Anhalt to create 3,000 jobs there, then you can say with a clear conscience that our start-ups have a significantly better ratio of invested capital to jobs created. To all DACH politicians reading this: Perhaps startups should be subsidised far more than they currently are in order to keep the DACH region internationally competitive in the future! But that's another topic...

So let's get back to the good old traditions: Once again this year, we would like to name our startups and entrepreneurs who have received special awards and express our appreciation:

🏆 ANYbotics. is honoured with the "Next Hot Global Thing" award.

🏆 CNC24has won the German Excellence Award 2023 in the "Digital Champions - Startups" category.

🏆 xorlab was recognised as a best-in-class cybersecurity solution in the Swiss Cyber Institute's latest manufacturer report.

🏆 Congratulations to Sandra Tobler und Futurae Technologies AG for the nomination as the most promising women-led startup in 2023.

🏆 ROOMZ impresses UNESCO with its environmentally friendly products

🏆 Calingo Insurance AGwon Top 100 Fintech Award,

🏆 ANYbotics.won the Top 100 Robotics Award

🏆 CNC24receivedWirtschaftsWoche "Startup of the Week"

🏆 Calingo Insurance AG was awarded InsurTech of the Year in the "Impact on the Swiss market" category.

🏆 Sinpexwon second #fintechgermanyaward2022 in the category Early Stage!

Honour to whom honour is due and we are really proud to be part of your journey!

About EquityPitcher

EquityPitcher itself also had a lot going for it in 2023:

We want to start with congratulations to our Managing Partnerin Andrea Buhofer for Forbes 30 under 30 zu gratulieren! Es hätte niemand Besseres ausgezeichnet werden können!

We are equally proud of the fact that, despite all the adversities, particularly in terms of raising capital, launch our third fund in July 23! This enables us to continue to invest in the most promising start-ups in the usual manner.

In 2023, our events aimed at connecting our network were once again a complete success:

Besonders gefreut haben uns die zwei ausserordentlich spannenden und gut besuchten LP-Events with ANYbotics. im März und bei Wingtra im November.

This year, we launched a new series of events with our Advisors - the first EquityPitcher Buureolympiade took place in October and, according to our advisors, was a real success/fun.

Das jährliche Come Together in Verbindung mit unserem Portfolio Exchange Day waren auch in 2023 wieder ein voller Erfolg. Den Tag durch durften unsere Startup Unternehmer von keinem geringeren als Roy Ranaani von chorus.ai in einem Workshop von dessen Erfahrungen zum Skalieren eines 500 Millionen Unternehmens profitieren.

Am Abend ging es dann für die +150 Teilnehmer bei wunderschönem Wetter und mit einer tollen Keynote von Prof. Glauner zum Thema AI weiter. Wobei auch hier die Zeit nach dem offiziellen Teil das Besondere ausmacht – nämlich dann, wenn unser wunderbares Netzwerk mit diesen herausragenden Menschen zusammenkommt und einfach den Moment geniesst!

We would also like to take this opportunity to thank you, dear investors, partners, advisors and start-ups, because without your support, none of what we are able to achieve year after year would be possible!

We would also like to take this opportunity to introduce our new Senior Analyst Marco Marugg who started with us in August!

To conclude, we would like to make a small Outlook for 2024 dare:

This year, we will remain true to our principles and - no matter how adverse the circumstances may be - continue to work seriously, honestly and professionally towards our goals and try to make the world a little bit better together with and through our start-ups - and hope and believe that 2024 will be a more peaceful year than 2023 and that the general macroeconomic trend will continue to improve.

Unsere Pipeline an neuen Startups ist jedenfalls prall gefüllt. 5 bestehende Portfolio Unternehmen planen noch in 2024 ihre Finanzierungsrunde zu schliessen und 2 Unternehmen befinden sich in finalen Exit-Verhandlungen.

With this in mind, we are very positive and looking forward to what is to come!

Herzliche venture Grüsse,

The EquityPitcher Team