Welcome Threedy

Threedy is a high-tech start-up founded in 2020 as a spin-off from Fraunhofer’s Institute for Computer Graphics Research (IGD) in Darmstadt, Germany. Three remarkably successful years after its foundation, Threedy has secured a $10.4 million investment to accelerate growth across industries and regions. New investors comprise LBBW Venture Capital, TRUMPF VENTURE, Futury Capital and EquityPitcher Ventures. The investment underlines Threedy’s strong position to capture a substantial market share of the fast-growing industrial digital twin space.

Digital transformation in industry

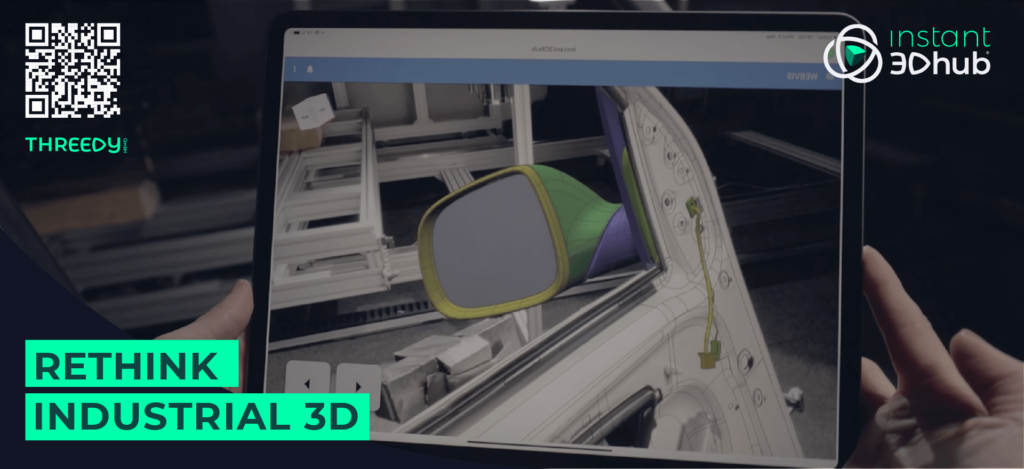

Threedy' s instant3Dhub is a high-performance spatial computing technology, enabling customer 3D data, any compositions, and its visualization at scale. By making data available and accessible in real-time on any device, at any time, it allows for the optimization of a multitude of digital processes all along the industrial value chain and a significant reduction in associated costs. Implementing instant3Dhub enables companies to save valuable time and resources, e.g. by eliminating waiting times, reducing license and infrastructure costs. Threedy allows its customers to establish a modern software architecture which reduces dependency on the monolithic and closed stacks of incumbent software vendors and opens the door to the agile development and scalable roll-out of a modern lightweight application layer. With a wide range of features for digital engineering, advanced collaboration, and seamless Mixed Reality, Threedy’ s software provides a strong foundation for industrial digital transformation.

Working with 3D data becomes as simple as sharing a link, simply by referencing it from arbitrary sources e.g., existing PDM/PLM solutions, and without any preparation or simplification efforts. Threedy’ s technology enables new, scalable applications over the entire product life cycle, from engineering to after sales - web-based and with zero-footprint on the client. By streamlining their 3D data utilization and communication, companies can also reduce their ecological footprint: business travel can be largely replaced by virtual exchanges, saving resources and time.

Rapidly growing number of partnerships and application scenarios

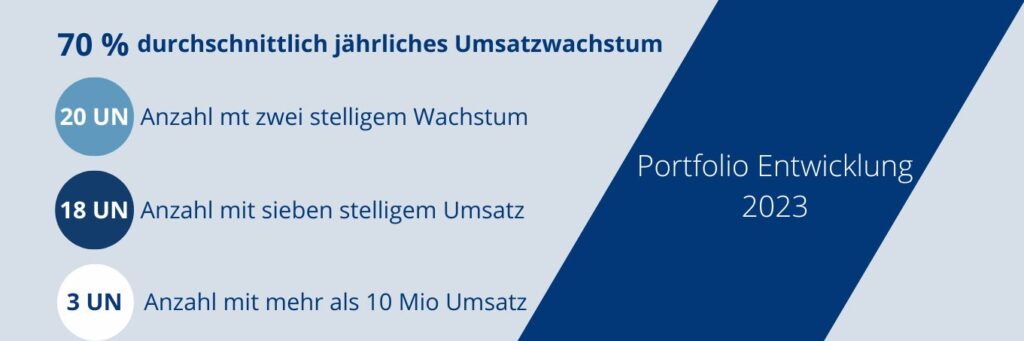

Over the first three years, Threedy successfully transformed from a Fraunhofer department to an independent company. Since its foundation in late 2020, Threedy has experienced significant growth, almost tripling its staff to build up a team of more than 50 highly skilled professionals from around the world. The company has not only maintained its strong customer relationships, but also experienced remarkable growth, especially in the Automotive and Manufacturing sectors. Threedy' s cutting-edge technology is valued by numerous industry leaders, including the top-tier German car Manufacturers. Furthermore, Threedy has successfully broadened its network of partnerships, expanding beyond the initial focus areas of Automotive and the German market.

With a substantial $10.4M Series A investment, Threedy is now ready for the next step, backed by the new investors LBBW Venture Capital, TRUMPF VENTURE, Futury Capital, and EquityPitcher Ventures. Existing investors Matterwave Ventures, Fraunhofer and High-Tech Gründerfonds (HTGF) renewed their commitment by participating in the Series A investment.

Threedy will continue its commitment to the commercialization of its innovative spatial computing infrastructure, accelerating the adoption across industries and application scenarios. The investment will further enable Threedy to drive the evolution of its product portfolio. Threedy’s expansion plans include further internationalization, while remaining dedicated to excellence and innovation, and making a lasting impact in serving their partners’ digital transformation. Threedy is now actively looking for new people in different roles to join its team, individuals who want to shape the future of the industrial digital twin space.